Boost 3X Sales

Improve Business

Speed up Closing

"PORTFO+ build up my team's professional image, it provides a systematic way to recruit, lead and train my new teammates."

Senior Recruiter (IFA)

"New Gen advisers LOVE digital tools, I like the policy summary pdf which can be done in a few minutes and clients like it."

New Gen Producer (Broker)

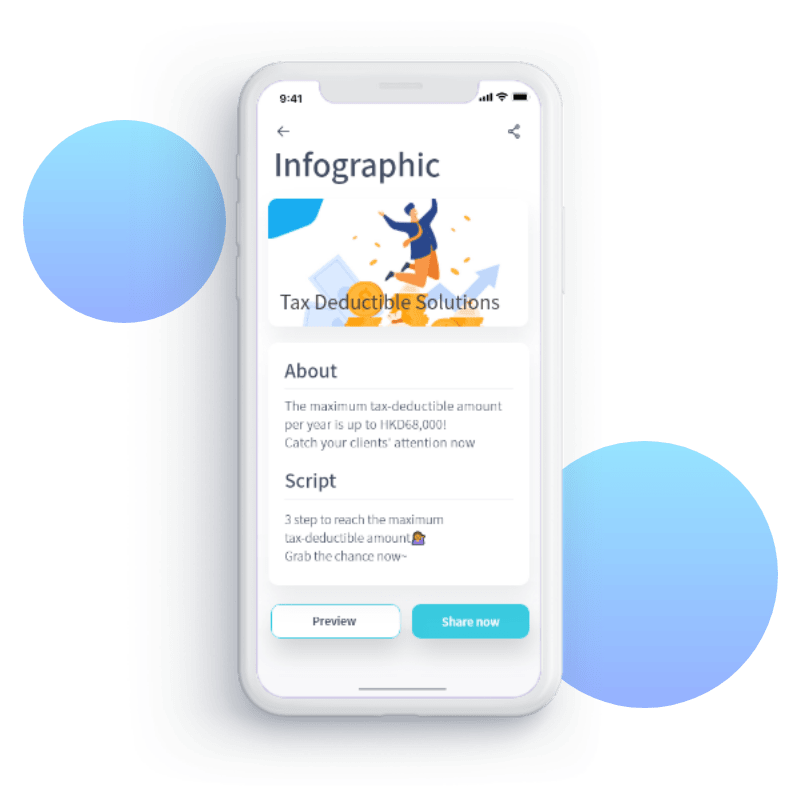

"The analysis tools help visualize the financial gap. Clients are more convinced to take up more coverage."

Top Financial Analyst (Agent)

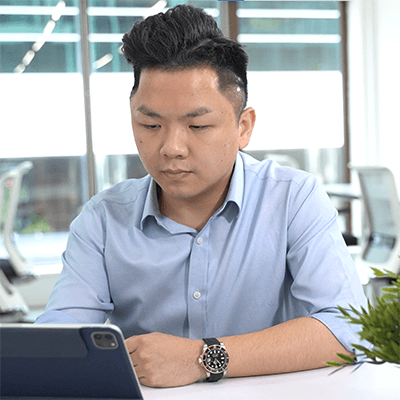

30+ financial infographics to draw client interest

Simple and effective ways to get referrals

Winning sales pitches that helps you win clients

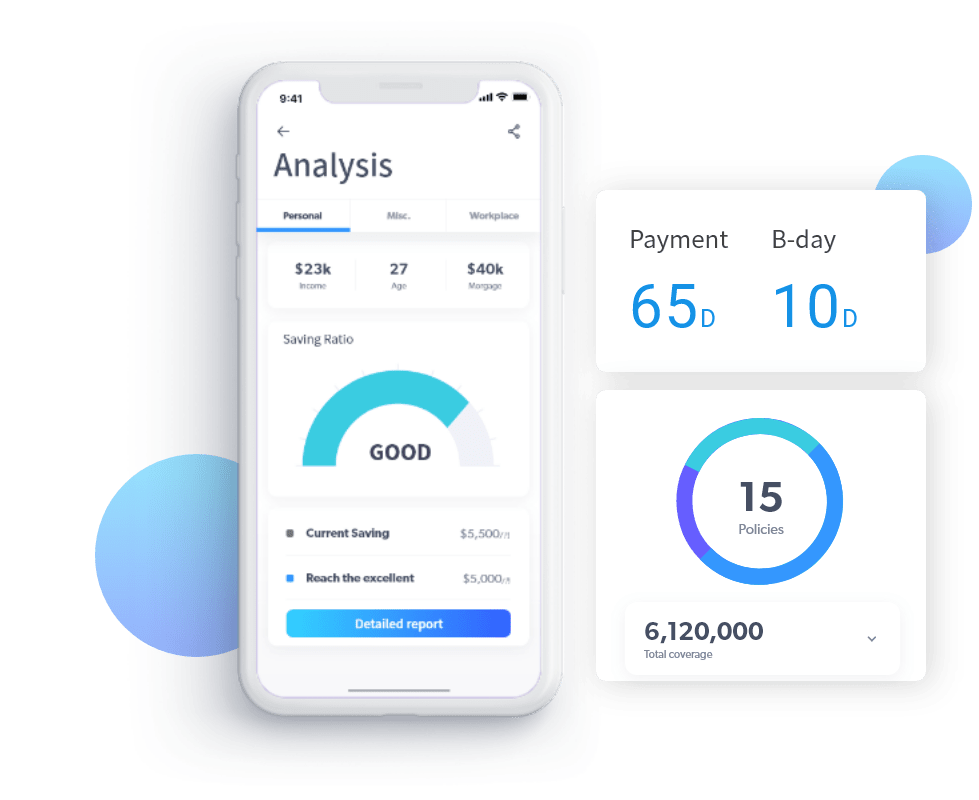

Consolidate portfolios with FinTech

Support ALL insurers and products

Create Policy Summary in 1-click

Interactive ways to let clients know their needs

Attactive visuals of financial concepts

Up-to-date market figures to support your advices

If you have any questions about our subscription plans, please feel free to contact us via WhatsApp.

The best way to use the platform in your insurance business.

Book a DemoAnnual plan Suitable for professional advisors

Activate NowIncludes basic features plus

Annual plan Suitable for professional advisors (most popular)

Activate NowIncludes basic and advisor plan features plus

Suitable for teams of 35 or more

Learn MoreIncludes basic and advanced advisor plan features plus

| Client | Pro | Team | |

|---|---|---|---|

| Personal & Attentive Client Services | |||

| Policy Consolidation | ✔ | ✔ | ✔ |

| Coverage Analysis | ✔ | ✔ | ✔ |

| Emergency contact of insurer, countries and SOS services | ✔ | ✔ | ✔ |

| DISC Personality Test | ✔ | ✔ | |

| Vision Board/Target Reminder | ✔ | ✔ | |

| Policy Expiration and Birthday Reminder for Advisers | ✔ | ✔ | |

| Export Protection Analysis & Policy Summary | ✔ | ✔ | |

| E-Name Card (Profile+) | ✔ | ✔ | |

| Smart assistant | ✔ | ✔ | |

| Professional Business Management | |||

| A.I. Client Potential Analysis | ✔ | ✔ | |

| Smart search, Identify Target Customers Quickly | ✔ | ✔ | |

| Door Opener e.g. Hot Topic, Medcard membership | ✔ | ✔ | |

| Fin.Pyramid/ Concept, Expense Analysis | ✔ | ✔ | |

| QR Code Client Referral System | ✔ | ✔ | |

| Big Data Analysis of Insurance Policies | ✔ | ✔ | |

| Potential Business Big Data | ✔ | ✔ | |

| Performance and Business Target Tracking | ✔ | ✔ | |

| Smart IDEA, Business Opportunities in 1 click | ✔ | ✔ | |

| Tag Analysis, Easily Classify and Filter Designated Clients | 20 Tags | 50 Tags | |

| Support Service | |||

| Self-Help Center | ✔ | ✔ | ✔ |

| Customized LOGO | (Add-on Service) | ✔ | |

| Recruitment Function | (Add-on Service) | ✔ | |

| Team Business Big Data | ✔ | ||

| Analysis of Team Activities | ✔ | ||

| On-site Sales Training (>20 team members) | ✔ | ||

| Tailor-made Recruiting material | ✔ | ||

| Tailor-made Sales material | ✔ | ||

| 2022 new era sales bookset | ✔ | ✔ | |

| Team Page and Board | ✔ | ||

| Plan Selection | |||

| Annual Plan (Mthly avg cost) |

- | HKD HKD282 |

Team Page | User Signup | Sign up NOW! | Contact Us |